What we buy

Previous section: What we eat and how we use the land

(Contents)

- Assembly members envisaged a future for 'what we buy' with five key elements:

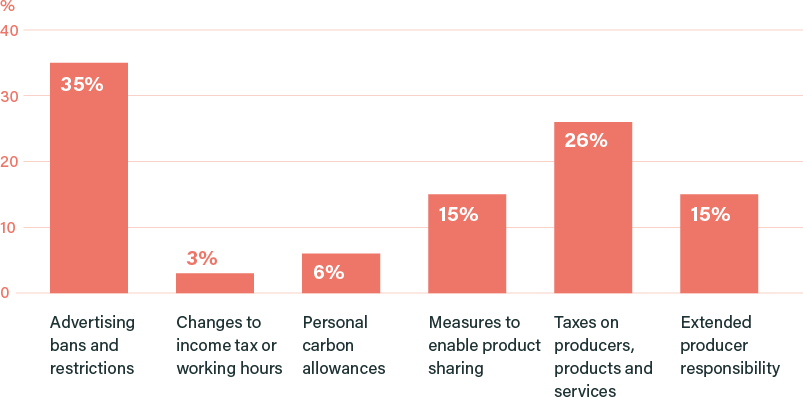

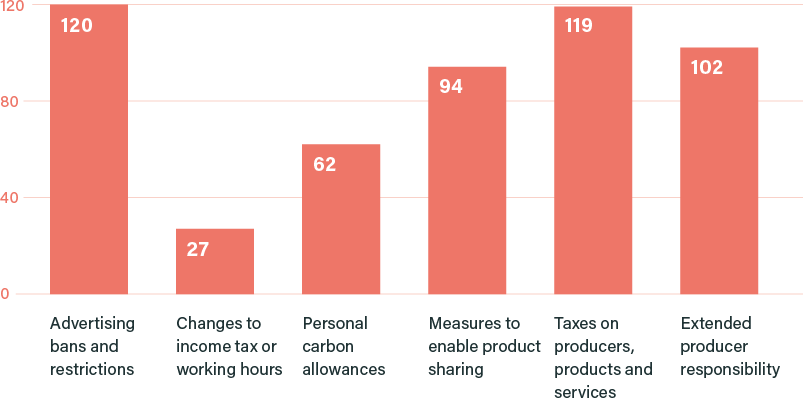

- Assembly members strongly supported businesses making products using less – and lower carbon – energy and materials. They backed a range of specific policies to further this aim, including 'resource efficiency targets and standards' (91%), an 'amended procedure for awarding government contracts that gives preference to low carbon companies and products' (83%), taxes on producers, products and services (83%), and 'extended producer responsibility' (79%).

- Assembly members supported the idea of individuals repairing and sharing more, with less purchasing of new products. They backed 'measures to enable product sharing' (77%) including technical and financial support to businesses who offer sharing or renting services.

- Assembly members' felt strongly about the need for better information to promote informed choice and changes in individual behaviour. They supported 'labelling and information about the carbon emissions caused by different products and services' (92%) and 'product labelling and information campaigns about what can be recycled and why it's important' (92%). They also backed 'advertising bans and restrictions' on high emissions products or sectors (74%).

- Assembly members supported a range of measures aimed at increasing recycling, including ' deposit return schemes' (86%), 'increased doorstep recycling' (85%), and 'grants and incentives for businesses' to improve recycling, develop new materials and make goods from recycled materials (77%). Their preferred future included businesses doing more to turn old products into new ones.

- Assembly members called for long-term commitment from government and Parliament. They emphasised the importance of cross-party support to prevent policies changing when governments change, as well as the need to look at both quick wins and long-term solutions.

- Some assembly members raised additional points for government and Parliament to consider around a need to take account of imports, ring-fence any tax revenue generated by the above policies, and protect consumers from increased costs. Some also highlighted trust and compliance issues relating to business, asking for transparency, honesty, strong enforcement, and reliable and independent information and schemes. Assembly members welcomed measures that would create additional job opportunities and stressed the need for a Just Transition.

- Assembly members were also clear about what they did not support. They did not back voluntary agreements, changes to income tax or working hours, personal carbon allowances, recycling requirements or pay-as-you-throw schemes. Their concerns included that measures would be ineffective or impractical, that they would penalise the less well-off, or that they would have unwanted side-effects such as an increase in fly-tipping.

The things we buy are linked to climate change because they use energy, and some of that energy comes from fossil fuels like oil, coal and gas.

They use energy:

- While they are being made – for example, to extract raw materials or in factories;

- Through services we use when we buy them – for example, we may buy products on the internet. The internet uses energy for tasks like powering the servers that store our data;

- Because of how they reach us – making packaging for products and transporting them to us uses energy;

- Some products need energy to run – for example, mobile phones, kitchen appliances and cars.

Throwing away products has implications for climate change too. The UK has traditionally sent most of its waste to landfill sites. Some of this waste generates potent greenhouse gases as it rots.

Most of the emissions linked to the goods and services we purchase are produced in the UK. Some, however, are produced in other countries. For example, a lot of the electronic products we buy, such as televisions and computers, are made abroad,1 meaning that the factories that make these products release their greenhouse gas emissions overseas. This still causes climate change: the greenhouse gases end up in the atmosphere whichever country they come from. However these overseas emissions are not included in the UK's net zero target.2

Notes ():

1: Allwood, J., Azevedo, J., Clare, A., Cleaver, C., et al. (2019). Absolute Zero. https://doi.org/10.17863/CAM.46075

2: We explained this fact to assembly members and provided them with brief information about UK and overseas emissions.

Thirty-five assembly members considered the topic of 'what we buy' in-depth. We selected these assembly members from the assembly as a whole using random stratified sampling. This ensured that they remained reflective of the wider UK population in terms of both demographics3 and their level of concern about climate change.

Notes ():

3: Age, gender, ethnicity, educational qualification, where in the UK they live and whether they live in an urban or rural area.

These assembly members heard a wide range of views on the future of 'what we buy' for the UK, and how we might move towards that future. They had the opportunity to question each speaker4 in detail. These evidence sessions took place at weekend two of the assembly.

Notes ():

4: The assembly heard from six speakers on what we buy: Professor Lorraine Whitmarsh, University of Bath (informant); Professor Mike Berners-Lee, Lancaster University; Professor John Barratt, University of Leeds (informant); Dr Nicole Koenig-Lewis, Cardiff Business School (informant); Julie Hill, WRAP (informant); Libby Peake, Green Alliance (informant). All speakers' presentations are available as slides, videos and transcripts at climateassembly.uk/resources/. An 'informant' is a speaker who we asked to cover the range of views and available evidence on a topic.

Assembly members spent weekend three of the assembly discussing the evidence they had heard and their own views in-depth, before reaching conclusions on three separate areas:

- Considerations: the overarching considerations that government and Parliament should bear in mind when making decisions about 'what we buy' and the path to net zero;

- Futures : what the future of 'what we buy' in the UK should look like;

- Policy options: how the UK should move toward this future.

Assembly members also had the opportunity to discuss and add anything else they wanted to say to government and Parliament about 'what we buy' and the path to net zero. Assembly members' views on the implications of Covid-19 for this topic are touched on in Chapter 10.

Assembly members reached their first decisions on 'what we buy' by discussing their answers to the following question:

What considerations should government and Parliament bear in mind when making decisions about what we buy and the path to net zero?

Assembly members thought about their answers to this question individually. They then discussed their views in small groups at their tables, with each table agreeing their five top considerations. These top considerations had to, between them, represent the range of views at the table.

Facilitators took these top considerations from each table and grouped similar options together to create a list on which assembly members could vote. They checked this list back with assembly members to make sure they had accurately reflected their views. This included making any necessary adjustments. Each assembly member could then vote for the four options that they felt to be most important.

The results were as follows. The wording of the considerations in the table is either word for word what assembly members wrote on their option cards or, where facilitators combined similar options from several tables, how we described the options to assembly members prior to the vote.

| Rank | Consideration | % assembly members who chose it as a priority |

|---|---|---|

1 | Education and information for consumers– including:

| 74 |

2 | Long-term commitment from government and Parliament– including:

| 69 |

3 | Regulate and incentivise companies to produce things that last longer – including:

| 60 |

4 | Benefit research, manufacturing and development in UK | 46 |

5 | Place controls and restrictions on advertising of environmentally damaging products, and label them clearly as such | 34 |

6 | Include quick-wins and long-term solutions – including:

| 31 |

7 | Create a culture through education to encourage minimising waste and to help establish community repair, re-use and recycle initiatives (e.g. better use of/access to dormant high street shops etc) | 23 |

8 | Take a nationwide, standard approach that makes it easy and possible for people to make changes | 14 |

9 | The polluter should pay (e.g. carbon allowance) | 14 |

10 | Be financially and geographically fair– including:

| 11 |

11 | Legislation for firms to reduce packaging | 0 |

12 | Create an overall differentiated strategy to ensure those who pollute and are super rich pay more than those who are less responsible and/or are less able to pay | 0 |

13 | Maintain and promote a healthy standard of living for everyone | 0 |

14 | Incentivise consumers to make the right choices through cost/tax (i.e. higher carbon = higher cost) | 0 |

After deciding their most important considerations, assembly members moved on to look at the future of 'what we buy' for the UK. To aid them in this process, the Expert Leads presented assembly members with three scenarios for possible futures:

- Efficiency and old-into-new;

- Repairing and sharing;

- Less stuff, more equality.

Together these scenarios or 'possible futures' cover a broad range of views about what could happen to help the UK meet its 2050 net zero target in terms of what we buy.

Assembly members discussed each 'possible future' in turn, before voting on them by secret ballot.

We start by presenting the rationale for their views, taking each possible future in turn.

This possible future would involve businesses making products using less energy and materials, and turning old products into new ones. Individuals wouldn't necessarily buy fewer things, but the things they buy would be less polluting. This scenario would feature changes for businesses and individuals.

What business would do:

- Use less energy and/or materials to make things;

- Avoid using high-emission materials – e.g. buildings could use more timber than cement;

- Use renewable energy (and electricity or hydrogen) instead of fossil fuels, and carbon capture and storage to stop remaining emissions getting into the atmosphere;

- Recycle more.

What individuals would do:

- Keep products in a good enough state so they can be returned to producers to be turned into new products;

- Recycle more.

Assembly members discussed this possible future at their tables. They identified the following pros and cons.

Pros

- Employment opportunities – some assembly members felt that this future would provide "additional employment opportunities" or "additional employment opportunities in remanufacturing." Others noted that it "protects jobs by transitioning into renewable industries."

- Recycling more and reducing waste – some assembly members felt it would lead us to "recycle more", or "recycle more (less waste to landfill)." Some noted that "sending less waste to landfill saves money and reduces pollution."

- Avoiding high emission materials – some assembly members liked that businesses would "avoid high emission materials" or "avoid using higher emissions materials", with some saying this meant there would be "no / little impact on individuals."

- Individuals don't need to change much – some assembly members liked that it requires "little change by individuals" or suggested it would have "minimal impact on people's lives but still [lead to] positive changes." Some suggested that it is "more efficient to change manufacturers rather than many individuals." Others liked that it "doesn't restrict consumer choice."

- Shared responsibility – some assembly members liked that this future "has a large effect on both firms and consumers i.e. not just focussed on consumers." Others said that "recycling is [for]…business and individuals: like consistency; like shared goal; like standardised."

- Saves money – some assembly members suggested that it "enables money saving", or meant "saving money – most people are money orientated (motivation)." Others felt that "some producers may save money in [the] long-run by being more efficient."

- Using timber – some assembly members liked the "change to timber frame buildings" or "using timber: innovation; new architecture; restore eco-systems."

- Using renewable energy – some assembly members liked the "use of renewable energy", the "increased use of renewable energy", or "renewable energy [and] carbon capture and storage."

- "Easy to implement"

Cons

- Very business led – some assembly members disliked that it "deferred responsibility from the individual to the manufacturer" or that there is "less that individuals can do to change things – very business led." Others noted that it "need[s] industry to change practices – may need incentives / training" or that "there could be difficulty enforcing regulations for businesses."

- Cost – some assembly members commented that it would result in "increased costs." Others suggested that it would be "expensive in the short term" or that there "may be upfront cost[s] for some measures."

- Job losses and impact on building trade – some assembly members said it would put "jobs at risk." Others expressed concerns about "job losses – steel", "cement and steel manufacturing – what will replace these materials / jobs?" or "timber / raw material imported from overseas – building trades lost [in UK}."

- Does it go far enough? – some assembly members noted that "efficiency has increased – will the gains in efficiency be enough? Concern it won't." Others queried "less public engagement – does this go far enough to meet net zero?" or commented "efficiency has increased but consumption has increased more, so [it] won't work if incentives aren't provided [to individuals] for green technology."

- Will products last? – some assembly members asked "will those new materials be strong enough in 20 years, with a changing climate." Others felt that "consumers may not follow manufacturers' instructions (e.g. maintenance and cleaning). Therefore products may not last as long."

- Doubts about repairs – some assembly members queried "is repairing broken products on a large scale practical?" Others suggested that "transport may be required for larger items to be sent or returned post repair."

- "Increase[d] use of timber"

- "No benefits for individuals – motivate"

- "Carbon storage" 5

Notes ():

5: The assembly went on to discuss carbon capture and storage in detail. Their thoughts and recommendations on it are presented in chapter nine.

Some assembly members noted conditions to their support for this possible future, or points that they felt would help its implementation:

- Just Transition 6 – some said that "industries and jobs need to adjust – need to manage a Just Transition";

- Training – some talked about the need for "suitable training courses for repair/renew employees";

- Carbon capture – some said they would want "carbon capture – but need more information."7 Others suggested we should "use natural carbon capture rather than carbon capture and storage";

- Need other measures too – some said it "would have to be alongside other actions."

Notes ():

6: There is no one agreed definition of what a Just Transition entails, but broadly it relates to who bears the cost of taking action on climate change. The Scottish Government's Just Transition Commission, which published its interim report in February 2020, suggested that, "The imperative of a just transition is that Governments design policies in a way that ensures the benefits of climate change action are shared widely, while the costs do not unfairly burden those least able to pay, or whose livelihoods are directly or indirectly at risk as the economy shifts and changes." https://www.gov.scot/publications/transition-commission-interim-report/.

7: The assembly went on to look at ways to remove greenhouses gases from the atmosphere in detail. Their recommendations on this topic are presented in chapter nine.

When we asked assembly members to vote on the three possible futures, this future received strong support from assembly members. Please see below for the results of the vote.

This possible future would involve making products that last longer, and people renting/sharing more and owning less. It would feature changes for businesses and individuals.

What business would do:

- Use less energy and/or materials to make things;

- Make products that last longer;

- Bring in systems for sharing, offer repair services etc.

- Recycle more.

What individuals would do:

- Replace products less frequently – e.g. half as often;

- Use fewer disposable things and reuse more things – e.g. using fewer disposable cups and more reusable ones;

- Own less and share or rent more – e.g. renting toys or tools;

- Get things repaired instead of throwing them away;

- Buy more second-hand rather than new things;

- Sell or gift products after use, or return them to the retailer/manufacturer, rather than throwing them away;

- Recycle more.

Assembly members discussed this possible future at their tables. They identified the following pros and cons.

Pros

- Sharing goods instead of owning – some assembly members felt that "renting for specific goods can be great, e.g. children's shoes renting costs less and [is] better for the environment." Others suggested that "sharing (cars) makes more sense", that "certain things are fine to rent: roof rack for your car (for your weekend) other things would be difficult" or that "sharing is great as it helps recycle instead of landfill (Freecycle8, social media etc)." Some liked the idea of "prioritising monthly subscriptions, leases and renting."

- Community and wellbeing benefits – some assembly members said it "could offer wellbeing and community benefits" or noted "well-being – social activities – repair cafes etc." Others said that "repair shops [mean] … well-being and community benefits – social interaction and fill empty high streets."

- Engagement and empowerment – some assembly members said that "people will feel more empowered to make the right decisions" or that there was potential for "engaging local communities."

- Repairs – several assembly members liked the idea of "promoting repairing", or "sending products back to manufacturers".

- Less waste – some assembly members supported "the idea of everyone recycling all waste household products (including food / garden waste)" or people "using less disposable things." Others said that "sending less waste to landfill saves money and reduces pollution."

- Skills and employment – some assembly members felt there would be "additional job opportunities", "increased employment opportunities", or "additional employment opportunities in product repair and servicing." Some liked the idea of "sharing skills and bringing back lost trades."

- Saving and making money – some assembly members suggested that "individuals can save money if products last longer and can be repaired." Others noted "opportunities for individuals to make money by selling used items" or an opportunity to "save / make money."

- Products that last longer – some assembly members commented that "quality products last longer and require less maintenance." Others liked that this future means we "use less energy / things last longer (repairable)."

- "Change in individuals' behaviour – a less consumerist society/more money"

- "Builds on the current service economy therefore easier to implement"

- "Buy more second-hand clothes. Baby clothes?"

Notes ():

8: This is a reference to The Freecycle Network www.freecycle.org

Cons

- Will industry change? – some assembly members asked "how can we convince companies to make products that last longer – they will lose money", or queried "industries to change – will they?" Others commented that this future "needs industry to change practices – may need incentives and training" or "industries to change – profits / incentives."

- Attitudes, including to sharing and buying second-hand – some assembly members felt "it would require a change in attitude towards using products" or said the "stigma about second hand items needs to change." Others questioned "how to change mindsets on sharing and buying second hand" or commented "there is a perception that people do not want to repair, share or rent: although it is a good thing that needs exploring."

- Cost of products – some assembly members said that "products may cost more if they are made to last longer."

- Cost of renting and repairing – some assembly members were concerned about the "cost of renting" or said that the "cost of repairs can be as much as buying new." Others felt that "rental [costs] would have to be substantially lower than [the] cost to buy."

- Inconvenience of renting and repairing – some assembly members said that "repairing and renting things may be more inconvenient than buying new" or commented "repairing / renting inconvenience – time." Some said they "like [the] idea of repairing and sharing but just don't see it working because it is so easy now to order a new product off the internet."

- Trust in quality of products – some assembly members said there was "no guarantee that the product will be up to standard and last" or that they would need "confidence in [the] longevity of recycled products."

- Job losses – some assembly members highlighted the "potential loss of jobs" or the "financial impact on businesses / jobs."

- "Unless sharing is organised and incentivised, very unrealistic"

- "Especially sharing or renting tools has unintended side effects (e.g. driving to shop and instead buy new as you don't have tools at hand)"

- "Need knowledge to do repair. Need time"

- "A health risk? Cross contamination infections"

- "It is difficult: would require training"

Some assembly members noted conditions to their support for this possible future, or points that they felt would help its implementation:

- Information – some said that "items that are rented or shared should have appropriate information regarding care and use."

- Changes to product design – some suggested that "products will need to be redesigned with easy to repair features and diagnostic parts (e.g. to fridge etc)."

- Ease of recycling – some said we need to "make the recycling process easy – e.g. label how to recycle the item."

When we asked assembly members to vote on the three possible futures, this future received some support from assembly members.

This possible future would involve people earning less and buying less, with them spending more time fixing and making things. It would feature changes for businesses and individuals:

What business would do:

- Make products that last longer;

- Employ people in more flexible ways and/or for fewer hours;

- Bring in systems for sharing, offering repair services, etc.

- Recycle more.

What individuals would do:

- Be taxed more if they are on higher incomes, or everyone could be given a 'carbon allowance'. This could result in less inequality;

- Work fewer hours or in more flexible ways – e.g. working from home. This could mean that people had more time to repair things or make things themselves, and this could be rewarded with 'community currencies'.

- Buy less stuff, including replacing products less frequently – e.g. half as often;

- Use fewer disposable things and reuse more things – e.g. using fewer disposable cups and more reusable ones;

- Buy more second-hand rather than new things;

- Recycle more.

Assembly members discussed this possible future at their tables. They identified the following pros and cons.

Pros

- Wellbeing and quality of life – some assembly members said that "flexible working leads to more quality family time", or that it would result in "more leisure and family time." Some liked the idea of "less working hours – flexible working to suit lifestyle." Others suggested it would "improve people's wellbeing and community" or "could improve wellbeing by working less and increasing time for leisure, family etc."

- Recycling and less waste – some assembly members liked that we would "recycle more", "recycling!" or that "everything [would be] produced so it can be recycled." Others said that it "uses fewer disposables" or that "less disposable means less waste." Some welcomed that we would "send less to landfill – local councils to consider options."

- Repairing, sharing and renting – some assembly members liked the idea of "sharing / repair services", "swap shops / centres", "recycle shops / centres" or "renting appliances / rental plans." Others talked about the "social and financial benefits of collective sharing and leasing."

- Benefits to the environment and biodiversity – some assembly members felt it would be "better for [the] environment" or suggested that "using less raw materials benefits biodiversity and [creates] less landfill."

- Equality – some assembly members liked the idea of "taxing higher earners" or "less difference in income between richest and poorest."

- Longer lasting products and saving money – some assembly members talked about "longer lasting products" or said "individuals could save money in [the] long-run if products last longer [or are] better quality."

- "Less stuff"

- "If demand decrease is targeted at high carbon goods and services [it will have] great effects (e.g. decreased imports). This will also help balance of payments deficits."

- "Local currencies have been around forever (e.g. bartering/LETS,9 Bristol pound)"

- "Carbon allowance"

Notes ():

9: LETS (Local Exchange Trading Systems) are community-based networks in which people exchange goods and services with one another, instead of using money (https://www.letslinkuk.net/).

Cons

- Working less is unappealing and counterproductive – some assembly members stated that "less working [is] not good" or that there would be "more social unrest if people have more time available." Others disliked that "they want us to work longer age wise, but less days/hours when you are fit and able." Some identified a "risk that having more spare time will lead to more consumption" or that "working less means more time to buy more stuff with less money."

- Job loss and economic damage – some assembly members suggested that "jobs will be at risk (industries)", that GDP [will be] down [and] unemployment up" or that "some industries [and] jobs will be at risk (e.g. manufacturing)." Others said it would make the UK "less internationally competitive, therefore less exports, therefore GDP down, therefore lower incomes may become a spiral if not controlled."

- Hard work not incentivised – some assembly members felt there would be "less incentive for people to work harder." Others were concerned about an "impact on social class movement – why work harder to get taxed more?" Some said that if you "limit earnings…[there is] less incentive to become industry leaders."

- Reduced income for high earners – some assembly members disliked "higher income [being] taxed more" or "reduce[d] income for [the] highest earners."

- Behaviour change unrealistic – some assembly members noted that this future would need a "change in individuals' values and lifestyle towards buying less (social barriers and fashion)" or said that "people might be reluctant to change behaviour in big ways." Some felt that "people working less will not use [their] spare time to repair things."

- Forced social change – some assembly members were concerned that this option would require "forced social change (using free time)" or would "chang[e] people's lives (e.g. less money, buying less)." Some said "people should have a choice. People like to have stuff. […] They love buying stuff. People like to buy new. That's human nature."

- Preferable to buy new – some assembly members noted that it's "sometimes cheaper to buy new" or that "repairing things [is] more inconvenient than buying new."

- Affordability and product costs – some assembly members suggested that "low income earner[s] may not be able to afford necessities" or that there may be an "increase in product costs." Others asked "if working less how would we ensure people could afford to live? Companies can't afford to pay more for less hours."

- "Lead[s] to a culture whereby people believe society owes them something rather than [asking] what people can do for society."

- "More income equals more tax for carbon emissions – may be unfair if not producing most carbon emissions"

- "Change will not happen quickly"

- "Need industry to change practices – may need incentives and training."

- "Carbon allowance [would be] difficult to monitor and implement."

Some assembly members noted conditions to their support for this possible future, or points that they felt would help its implementation

- Recycling – some said that "recycling needs to be more available";

- Need to change values – some said that a "change in values is a condition for change in behaviour."

When we asked assembly members to vote on the three possible futures, this future received limited support from assembly members.

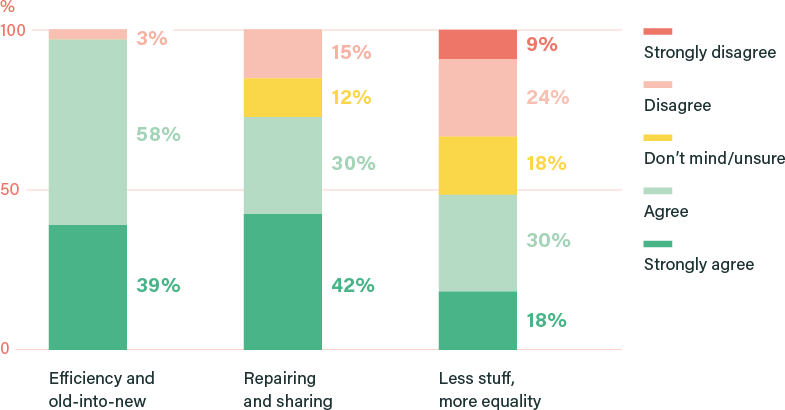

Assembly members voted on the futures by secret ballot. There were two different ballot papers. The first ballot paper asked assembly members how much they agreed or disagreed that each future should be part of how the UK gets to net zero. The second ballot paper asked them to rank the futures in their order of preference.

Efficiency and old-into-new

39% Strongly Agree

58% Agree

0% Don’t mind or unsure

3% Disagree

0% Strongly disagree

Repairing and sharing

42% Strongly Agree

30% Agree

12% Don’t mind or unsure

15% Disagree

0% Strongly disagree

Less stuff, more equality

18% Strongly Agree

30% Agree

18% Don’t mind or unsure

24% Disagree

9% Strongly disagree

Figure 1: Possible futures: How much do you agree or disagree that each of the possible futures should be part of how the UK gets to net zero? (%)

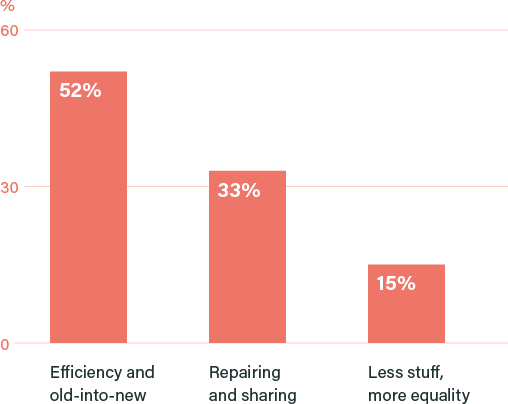

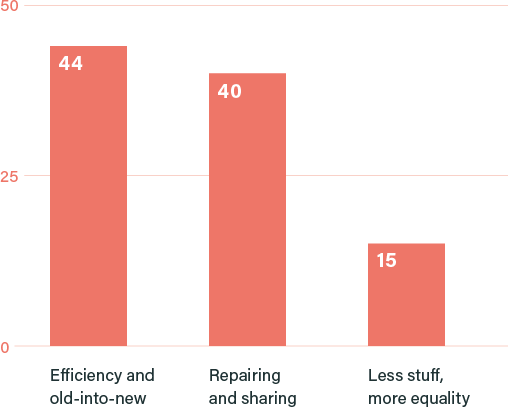

The votes from this second ballot paper were counted in two ways:

- Counting assembly members' first preference votes only. This tells us what assembly members would and wouldn't choose if they could have their most preferred future.

- Using Borda count. This involves allocating points for preferences – a first preference vote scored two points, a second preference vote one point and a third preference no points. Counting the votes like this tells us which futures are most acceptable to the greatest number of assembly members.

Assembly members showed significant support for two futures :

- 97% of assembly members 'strongly agreed' or 'agreed' that 'efficiency and old into new' should be part of how the UK gets to net zero;

- 72% 'strongly agreed' or 'agreed' with 'repairing and sharing'. 15% of assembly members 'disagreed' with this possible future; no one 'strongly disagreed'.

Assembly members were less supportive of 'less stuff, more equality.' 48% of assembly members 'strongly agreed' or 'agreed' that it should be part of how the UK gets to net zero. 24% 'disagreed' and 9% 'strongly disagreed'. 18% were unsure.

Figure 2: Possible futures: Please rank the possible futures in order of preference (% 1st preference votes)

Figure 3: Possible futures: Please rank the possible futures in order of preference (Borda count)

The ranking votes reinforced these results. 'Efficiency and old-into-new' remained the most popular future, with 52% of first preference votes. 'Repairing and sharing' came second with 33% of votes, followed by 'less stuff, more equality' with 15%. The Borda count scores followed the same pattern, although with a smaller difference in popularity between 'efficiency and old-into-new' and 'repairing and sharing'.

Overall, assembly members backed a future in which both businesses and individuals would need to change some aspects of their current practices and behaviours.

For businesses, assembly members strongly supported a future in which they would:

- Make products using less, and lower carbon, energy and materials;

- Turn old products into new ones, and recycle more.

They also supported steps that businesses could take to help people buy less, including making longer lasting products, and offering repair services and sharing systems.

For individuals, assembly members backed a move towards greater sharing and repairing, as opposed to buying new goods. They did not, overall support bigger shifts in how society works aimed at reducing the amount we buy, for example changes to how much people work and earn.

Assembly members consistently welcomed opportunities for job creation, reduced waste and increased recycling. They noted that sharing would work well for specific items such children's shoes, and felt it had potential benefits for communities and wellbeing.

Assembly members tended to see potential increased costs for consumers and negative impacts on specific economic sectors as concerns. They emphasised the importance of a Just Transition for those adversely affected by the changes. They also highlighted the need for plans to be realistic, suggesting for example changes to product design and information to make items easier to care for and repair.

Assembly members looked at six policy options for reducing emissions from products and services:

- Resource efficiency targets and standards;

- Taxes on producers, products and services;

- Extended producer responsibility;

- Amended procedure for awarding government contracts;

- Voluntary agreements;

- Labelling and information.

We start by presenting the rationale for their views, taking each policy option in turn.

Resource efficiency targets and standards

This policy option would involve industry ensuring that it met certain levels of resource and/or energy efficiency. For example, it might mean that products could only be sold if they met rules for how long they last, whether they can be repaired or reused, and/or how much energy or materials went into making them. The targets and standards could apply to all industry or only to high-emitting sectors, such as construction and fashion.

Assembly members identified the following pros and cons about resource efficiency targets and standards.

Pros

- Quick win – some assembly members described them as "quick wins – removing [the] most polluting products cuts greenhouse gas emissions" or said the UK would "see effects quickly." Other said that "setting regulations at top level [is the] fastest option."

- Enforcing change – some assembly members liked that they "can be done by legislation" or that it's "government enforcing change and drawing [a] line in [the] sand and [being] bold."

- Better production and design – some assembly members suggested they allowed for "changes from start of production" or that they would "promp[t] better design."

- "Saves firms money in long run so they will support"

- "Already know it works (already having an impact)"

Cons

- "Restricts choice"

- "Increased product costs"

- "Complicated to set up and inspect"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Include all industries – some said that it "should target all industries (more fair) but could tailor";

- Protect consumers – some said they would support it "if consumers [are] protected from increased costs";

- Take account of imports – some said it "must take into account products from outside [the] UK" or asked "how would this work for imports?";

- Needs correct assessment of carbon emissions – some said that it would need "assessment of [the] product from cradle to grave", that it should take account of the "carbon footprint of products not just from production but how far they have travelled too", or noted that it "depends on [the] correct carbon measurement / footprint."

Taxes on producers, products and services

This policy option would involve (a) reducing or scrapping taxes on greener products or services to make them cheaper; and/or (b) raising taxes on more polluting products and services to make them more expensive. It could include taxes on advertising that go up according to the carbon content of the product or service being advertised.

Assembly members identified the following pros and cons about taxes on producers, products and services.

Pros

- Impact – some assembly members said its "already proved to be working with energy use – keep going!" or that it's "possible and could make a difference." Some suggested we would "see effects quickly" or liked that it's "government enforcing change and bold."

- Encourages better producer behaviour – some assembly members said it "encourages better producer behaviour" or that reduced "taxes on greener products [would make them]…more attractive to businesses."

- "No downsides"

- "Tackles advertising"

- "Carbon tax based on carbon footprint labelling/scoring"

- "Makes green products more affordable"

- "Increases investment from other countries if tax regime is favourable"

- "Can be transparent legislation for businesses"

Cons

- May not change consumer behaviour – some assembly members said that the "wealthy could continue to buy less green options" or that it "might not actually make people buy less e.g. if cost not driving factor."10

- "Restricts choice"

- "Might be hard to negotiate"

- "Don't like additional tax"

- "Consumers may choose imports without this tax"

- "May encourage UK producers to move abroad for carbon-heavy goods"

Notes ():

10: Assembly members considered 'taxes on producers, products and services' both as a way to reduce emissions from products and services, and as a way to encourage people to buy less (please see page 341). Assembly members made this point when they were considering the impacts of the taxes on consumer behaviour.

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Protect consumers – some queried "will these [costs] just be transferred to [the] consumer?";

- Ring-fence the tax revenue – some said that the "tax revenue [should be] ring-fenced for carbon offsetting" or that the "tax must be ring-fenced to be spent on climate change";

- Take imports into account – some said we should "tax imported goods as well" or asked "how would this work for imports?";

- Reward but don't punish – some asked for a "focus on rewards not punishment." Others suggested "what about tax exemptions – would be positive."

Extended producer responsibility

Extended producer responsibility would mean that producers pay for the impact of their products and packaging on climate change. It could also include either or both of:

- Restrictions on the practice of intentionally making products that don't last long;

- Requirements for how long products need to last.

The UK government is already planning to introduce extended producer responsibility for packaging and may do so for other products.11

Assembly members identified the following pros and cons about extended producer responsibility.

Pros

- Impact – some assembly members said that "firms paying for their impact…will lead to firms' behaviour change" or that it "already works – legislation makes companies produce low carbon products." Others said it "reduces how much producers pollute + what they do with that pollution."

- Longer lasting products and better services – some assembly members said that "built in redundancy [i.e. products built not to last] should be made illegal" or that "if [products] are made to last longer then it'll be worthwhile." Others said it would result in companies "offering better services / builds stronger relationship."

- "Reduces waste"

- "Government enforcing change."

Cons

- Only the UK – some assembly members disliked that it "only affects UK industry." Others said it would be "impossible to implement because of current manufacturing standards abroad", that it would be "difficult to hold foreign companies to account" or that "international trades (e.g. products from China) make it difficult to guarantee extended producer responsibility."

- "May increase firms' costs and so may cause them to go abroad"

- "Too much focus on recycling, but need to look at reduction"

- "Restricts choice"

- "We don't know what it will cost"

- "For how long should products last – not always producers' fault (depends on consumer)"

- "Not strong enough, could be a cost absorbed by the business. Would need to be a fine with consequences e.g. not able trade or sell certain products"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Protect consumers – some asked "will [costs] be just transferred to [the] consumer?";

- Ring-fence any tax revenue – some said that any "tax revenue [should be] ring-fenced for carbon offsetting";

- Combine with resource efficiency targets and standards – some said it "should go hand in hand with 1a [resource efficiency targets and standards] – it's about making producers be responsible";

- Take account of imports – some said it "must take into account products from outside [the] UK."

Amended procedure for awarding government contracts

This policy option would amend the procedure for awarding government contracts, so that it giving preference to low carbon companies and products. It could involve creating an approved list of low carbon technologies, products or materials (e.g. renewable energy, the use of wood in building construction, recycled materials) for use by public sector bodies.

Assembly members identified the following pros and cons about amending government contracts in this way.

Pros

- Government leadership – some assembly members said that "government should take the lead" or that "government are big spenders [which means they have] big impact and influence."

- Benefits for green companies and competition – some assembly members liked that it "makes green companies competitive" or that it would "make green companies more competitive so would encourage competition between companies." Others liked that it's "rewarding companies that are low-carbon."

- "Healthy for reducing carbon in products"

- "Doesn't restrict product choice"

- "Simple and easy to do"

- "No brainer"

Cons

- "Not enough – business in private sector"

- "Could lead to higher cost to taxpayer"

- "Complex – carbon can't be the only factor. Also cost, timescale"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Budget – some said government and public sector bodies "must have [the] budget to pay for more expensive but green products / services";

- Standards – some suggested it "needs standards – legislation";

- Governance – some assembly members questioned "who …[the] governing body [would be]."

Voluntary agreements

Voluntary agreements mean trade organisations, producers and/or retailers adopting voluntary commitments. They would commit to reducing carbon emissions from the production or use of products, and/or to only selling low carbon products. There could be rankings and awards, so that product manufacturers and sellers are publicly celebrated for low carbon performance.

Assembly members identified the following pros and cons about voluntary agreements

Pros

- Promoting competition and spreading best practice – some assembly members suggested that it "can help promote competition and spread best practice amongst businesses." Others said "firms respond to reputation risks / opportunities" or that they liked that it was "not strict and promotes competition."

- Awards and rewards – some assembly members said that "consumers do pay attention to ranking and awards" or liked that there "can be [an] advertising plus for companies – rewards there."

- "Gives choice"

Cons

- Won't create change – some assembly members disliked that it's "voluntary" saying that we "need to force people to change", or that it "won't amount to enough – must force change." Others said that voluntary agreements are "not bold enough on their own", that "businesses might take easy options" or that "voluntary agreements [are] not worth the paper they are written on…profits trump everything."

- "Can't trust companies / may present biased info"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Independent – some said it "can't be industry-run; it has to be independent" or that "awards must be given by [an] independent body";

- Take services into account – some asked "how [would it] work for services?"

Labelling and information

Labelling would show the carbon emissions caused by different products and services. Labels could also show which products are more durable and designed for reuse. This could be accompanied by information campaigns. These would educate individuals about the emissions caused by different products and services, and how to reduce them.

Assembly members identified the following pros and cons about labelling and information

Pros

- Consumer choice – some assembly members liked that there are "still consumer choices", that it "gives choice", "gives consumer[s] the choice" or that it's "not strict and [is] voluntary." Others felt it "respects [the] public and gives choice."

- Increasing awareness – some assembly members said that "knowledge is power" or that it "brings [it to] people's attention." Others said that "[education and awareness for consumers was] our top principle."12

- Will lead to change – some assembly members said they "think it will lead to behaviour change e.g. smoking campaign", that they "think people would change", or that "visual things impact people."

- "The manufacturers' incentives"

- "Easy and simple – traffic light system"

Notes ():

12: Please see Section A at the start of this chapter.

Cons

- Won't create change – some assembly members felt it was "not bold enough on its own" or that it "might not change purchase of familiar products." Others described it as "light touch – how much difference is it actually going to make? Easy thing to do – probably won't make a huge impact."

- "Harder to trace products' carbon from abroad"

No assembly members noted conditions for this policy option.

General comments

Some assembly members made general comments about policies to reduce emissions from products and services. Many of these comments touched on the idea of trust. Some mentioned it directly. Others expressed concerns about company behaviour and compliance, emphasised the need for regulation, or called for transparency:

"What a total nightmare! i.e. a minefield of complexity and avoidance, and 'gentlemen's agreements' between companies – transnational and international."

"How to regulate?"

"Penalties, charges or taxes against those who create polluting products should be made public and transparent. [There] [s]hould be real and significant fines and consequences that act as a real deterrent."

"Important for [the] 'ordinary person' to be able to trust labelling and marketing messages. Can Government reward 'honesty' and punish dishonesty."

"Like honesty and transparency … but how to be confident of [it]? Independent scrutiny body? Outside and independent of government."

Other assembly members said that "government should set standards", that we should look for "quick wins", or that they liked measures that "encourag[e] better design." Some said they "like [the] suggestion of [a] Carbon Tax that applies to all companies regardless of where they're based ifthey trade/operate in [the] UK."

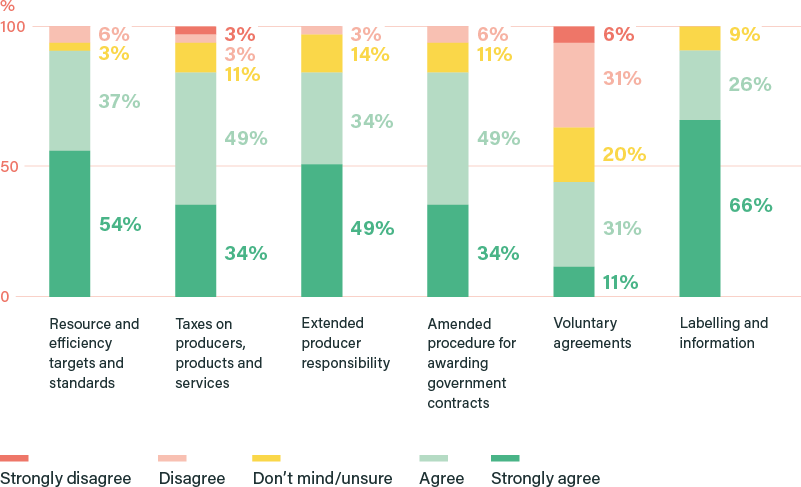

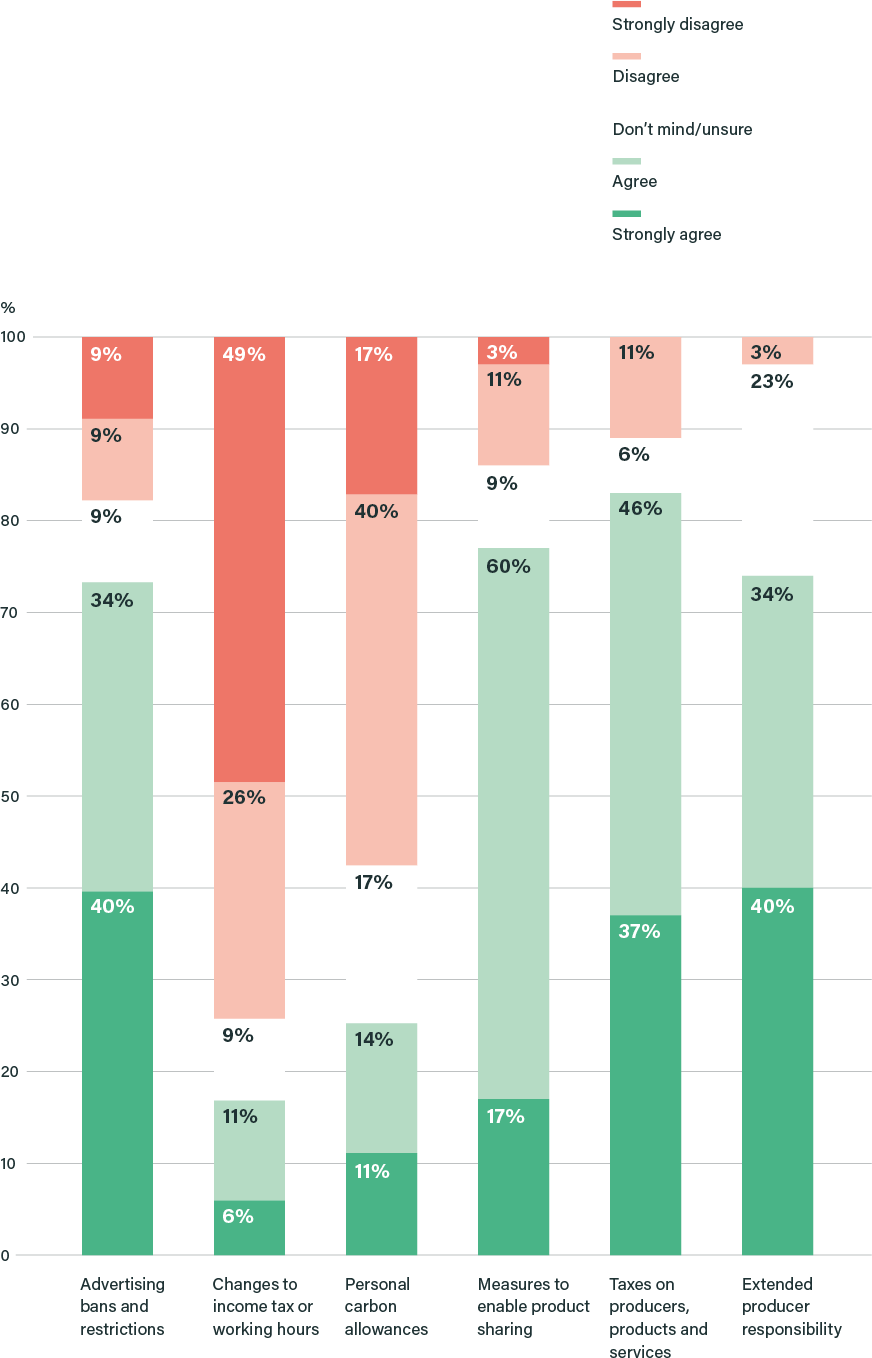

Vote results

Assembly members voted by secret ballot on policy options for reducing emissions from products and services. There were two ballot papers. The first ballot paper asked assembly members how much they agreed or disagreed that each policy option should be part of how the UK gets to net zero. The second ballot paper asked them to rank the options in their order of preference. The votes from this second ballot paper were counted both in terms of first preference votes and via Borda count.

Resource and efficiency targets and standards

54% Strongly Agree

37% Agree

3% Don’t mind or unsure

6% Disagree

0% Strongly disagree

Taxes on producers, products and services

34% Strongly Agree

49% Agree

11% Don’t mind or unsure

3% Disagree

3% Strongly disagree

Extended producer responsibility

49% Strongly Agree

34% Agree

14% Don’t mind or unsure

3% Disagree

0% Strongly disagree

Amended procedure for awarding government contracts

34% Strongly Agree

49% Agree

11% Don’t mind or unsure

6% Disagree

0% Strongly disagree

Voluntary agreements

11% Strongly Agree

31% Agree

20% Don’t mind or unsure

31% Disagree

6% Strongly disagree

Labelling and information

11% Strongly Agree

31% Agree

20% Don’t mind or unsure

31% Disagree

6% Strongly disagree

Figure 4: Reducing emissions from products and services: How much do you agree or disagree that each of the following policy options should be part of how the UK gets to net zero? (%)

A large majority of assembly members 'strongly agreed' or 'agreed' that five of the six policy ideas should be part of how the UK gets to net zero:

- 'Labelling and information' – 92% 'strongly agreed' or 'agreed'

- 'Resource efficiency targets and standards' – 91%;

- 'Extended producer responsibility' – 83%;

- 'Taxes on producers, products and services' – 83%;

- 'Government contracts' – 83%.

Only a small number of assembly members 'strongly disagreed' or 'disagreed' with any of these proposals. No one disagreed with 'labelling and information'.

In contrast, only a minority of assembly members (42%) backed voluntary agreements, with 37% 'strongly disagreeing' or 'disagreeing' that they should be part of how the UK gets to net zero. 20% of assembly members said they were 'unsure' or 'didn't mind'.

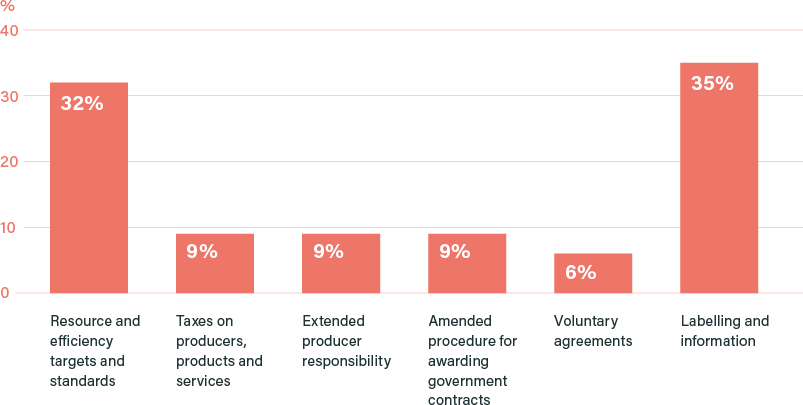

Resource and efficiency targets and standards 32%

Taxes on producers, products and services 9%

Extended producer responsibility 9%

Amended procedure for awarding government contracts 9%

Voluntary agreements 6%

Labelling and information 35%

Figure 5: Reducing emissions from products and services: Please rank the following policy options in order of preference (% 1st preference votes)

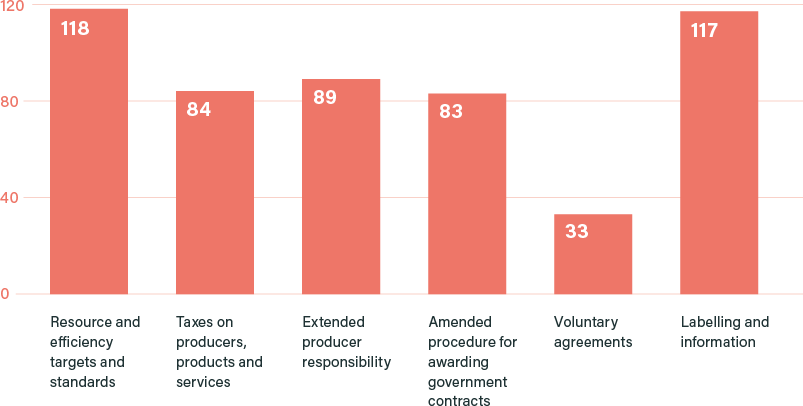

Resource and efficiency targets and standards 118

Taxes on producers, products and services 84

Extended producer responsibility 89

Amended procedure for awarding government contracts 83

Voluntary agreements 33

Labelling and information 117

Figure 6: Reducing emissions from products and services: Please rank the following policy options in order of preference (Borda count)

The ranking vote largely reinforced these results. 'Labelling and information' and 'resource and efficiency targets and standards' strengthened their position as the two most popular policy options. They were followed by the three other proposals that received strong support in the first vote. Voluntary agreements remained the least popular option.

Assembly members looked at six options for increasing recycling:

- Recycling requirements;

- Pay-as-you-throw schemes;

- Deposit return schemes;

- Increased doorstep recycling;

- Grants and incentives for business;

- Product labelling and information campaigns.

We start by presenting the rationale for their views, taking each policy option in turn.

Recycling requirements

Recycling requirements would involve retailers and/or consumers being responsible for recycling products, with a ban on landfilling. It could eventually mean that councils do not collect 'black bin' rubbish. The requirements could be phased in over many years to allow individuals and businesses time to adapt.

Assembly members identified the following pros and cons about recycling requirements.

Pros

- Change in company practice – some assembly members said it "will encourage greener products from companies" or that "recycling requirements are great as it forces firms to change, therefore there will be a large impact."

- "Would increase recycling"

- "Would reduce emissions"

- "Good principle"

- "Less cost with no black bins"

- "Reducing landfill"

Cons

- Fly-tipping – some assembly members noted "concern about fly-tipping", the "risk of fly-tipping" or fears about "making fly-tipping worse." Some said that "if councils do not collect 'black bin' rubbish [we would have] fears over litter and fly-tipping", or queried what would happen to "existing non recyclable items – fly-tipping?" Some suggested that the "introduction of [the] waste licence has already led to fly-tipping" or that "fly-tipping is a consequence of [the] cost of collection of waste."

- Time – some assembly members disliked that it is "not effective immediately" or that it "would have to be phased in." Others said "it's a long way away, good idea but need [the] infrastructure. Not a quick win."

- "Can't get rid of black bins. Will always have waste that can't be recycled"

- "Encourages stream of cars to take things to the tip"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Get on with it – some said "we should set a target soon and don't wait!";

- Education – some said we "need to educate people [about] how to recycle effectively";

- Standardised approach – some said it "needs to be uniform" or that it "need[s] [a] standardised approach across the country (and packaging labels [that] matc[h] bin colour)";

- Incentivise too – some said they wanted "incentive[s] pair[ed] with requirements in order to make it a 'better pill to swallow' therefore firms are more likely to go along with it."

Pay-as-you-throw schemes

Pay-as-you-throw schemes involve individuals and businesses paying for waste that is not recycled (i.e. the amount of waste in their 'black bin'), but not for recycled or composted waste. The schemes could be introduced with exemptions or to reflect household occupancy (e.g. more bins for more people).

Assembly members identified the following pros and cons about pay-as-you-throw schemes.

Pros

- Encourages behaviour change – some assembly members suggested it would "encourag[e] people to buy less over time – gets people to recycle who don't already." Others said it would "sto[p] bad behaviour", that "people would improve [their] behaviour" or that "having to pay makes a difference."

- "Increase recycling but less strict than 3a [recycling requirements]"

- "Looks like it could work elsewhere"

Cons

- Impact on the less well-off – some assembly members suggested it "could hit low-income households. Everyone is paying council tax already." Others said it's "wrong to hit [the] vulnerable", that it "favours [the] rich, who can afford to throw", or that "recycling options are worse for low-income areas."

- Fly tipping and anti-social behaviour – some assembly members felt it would "mak[e] fly-tipping worse", that it would "encourage antisocial waste disposal i.e. in neighbour's bin" or that it had "fly-tipping risks and putting rubbish in other people's bins or wrong bins."

- Practicality and enforcement – some assembly members queried "not practical? Weigh as you take it?" Others said "some people won't pay – makes no difference" or expressed concerns about the "cost of enforcement."

- It won't work – some assembly members said that "punishing people is not going to work" or that "it sounds like a good idea, but it's not going to work."

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Avoid impacting the less well-off – some commented that it's "good but needs to relate to income / [the] tax band of [the] property to avoid impacting low income households";

- Scrap payments – some said they would support it "only if households don't pay (already pay with council tax)";

- Consider shared bins – some queried "flats/shared bins?"

Deposit return schemes

Deposit return schemes encourage the collection of used containers, so that they can be recycled or reused. The customer pays a small sum on top of the retail price when they buy a product (e.g. a bottled or canned drink), which is refunded when the container is returned to a collection point. The bottle or can is then either refilled or sent for recycling. Deposit return schemes could be extended to incentivise individuals to sort other unwanted goods they own (e.g. clothes, furniture) for reuse, remanufacture or recycling.

The UK government has promised a deposit-return scheme for plastic, glass and possibly metal by 2023.13

Assembly members identified a number of pros and cons about deposit return schemes.

Pros

- Tried and tested – some assembly members said "it already exists and works – encourages reuse." Others said "we used to do this and it worked" or that it's "tried and tested." Others said it is "like existing European schemes" or that there is "evidence of [it] working abroad."

- Encourages good behaviour – some assembly members suggested it "discourages throwing away including litter" or that it "rewards good behaviour." Others commented "like this one, good evidence, excuse to pick up litter (incentive)."

- "Incentivises people in lower income areas"

- "More fair"

- "This could be rolled out for cleaning products and then work out how to solve the food problems"

- "Simple"

- "Already in government plans"

Cons

- Need for infrastructure – some assembly members disliked that it "needs infrastructure" or the "infrastructur[e], but mitigated by the benefits of setting up [the] schemes."

- "Some people won't bother if they don't understand"

- "Open to abuse for people to contaminate the containers"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Make it easy and accessible for all – some said they "don't mind who pays you back i.e. company / council but [it] needs to be easy." Others said it "needs to be accessible including for disabled people."

- Look at who pays you back – some asked "who gives £ back?"

- Try it first – some recommended that we "see how [the] government['s] existing plans go, then see."

Increased doorstep recycling

Increased doorstep recycling would involve local councils providing doorstep recycling for all recyclable materials. The UK Government has said it will expect all councils to collect at least the same 'core' list of recyclable materials from householders, although the exact details / dates are to be confirmed.14

Assembly members identified the following pros and cons about increased doorstep recycling.

Pros

- Consistency – some assembly members liked the "consistency", or that it "gives everyone the same recycling opportunities across the UK." Others commented that it's "positive to make recycling collection consistent and standardised. Need all households to compost." Some suggested that a "standard process for recycling will help clarify the message on what can be recycled."

- Extends current system – some assembly members said it "already exists – should be scaled up – with incentive/penalties." Others liked that it "extends the current system and [creates a] uniform approach around the country."

- "National policy and central system"

Cons

- Extra cost for individuals – some assembly members noted "already high council tax rates – higher costs will inevitably be passed on to individuals." Others highlighted "concern about cost to [the] taxpayer" or said "councils can't afford it – higher council tax?"

- "Costs for local councils"

- "Will still have landfill"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Funding and incentives – some said it "shouldn't be added to our council tax", or asked "how to fund [it]? [It needs] [b]udget for councils from central government to do [it]." Others suggested it "need[s] incentive[s] for councils to do it";

- Information – some said we would "need clear information on what [we] can recycle", that it needs to happen "plus public awareness", or that it is "dependent on 3f [product labelling and information campaigns";

- What is recycled and making it work for everyone – some said that "councils should recycle even what households can't be bothered to do." Others stated that it "need[s] to account for people with medical issues and medical waste";

- Who benefits – some specified that "benefits need to go to [the] local area."

Grants and incentives for business

This policy option would involve government providing grants to businesses to:

- Improve recycling (e.g. for batteries, steel);

- Develop new materials (e.g. alternatives to cement);

- Make goods from recycled materials; and/or

- Use more efficient production methods.

It could also include financial support for businesses wanting to move away from manufacturing to providing more sharing services, such as repairs or rentals.

Assembly members identified the following pros and cons about grants and incentives for business.

Pros

- Supports businesses – some liked that it "provides support for business" or makes it "easier for business." Others said it would be "popular for business as [it's a] safe option."

- Encourages positive behaviour and ideas – some assembly members said the "reduced risks would encourage people to recycle." Others felt it would "encourage businesses to come up with new ideas for reducing emissions" or "motivat[e] businesses to come up with innovations." Some liked the idea of "grants for business to improve recycling." Others said it's an "incentive [to] pair with requirements in order to make it a 'better pill to swallow' therefore firms are more likely to go along with it."

- "Business need to play their part"

Cons

- Not guaranteed to achieve what we want – some assembly members felt change was "not guaranteed" or that there is "no guarantee that this would effectively lead to reduced emissions."

- "Will change as governments change"

- "Can't see benefit straight away (other options are more short term/quick)"

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Who receives the funds – some asked "why give businesses grants to develop new materials? Wouldn't it be better to invest in universities instead (to do this research)??" Others agreed, saying "if it was grants to universities for research, would be easier to accept";

- Supporting set-up – some suggested "grants initially for set up e.g. first 2 years."

Product labelling and information campaigns

Product labelling would show more clearly and consistently which products and materials can be recycled. Labelling could be accompanied by information campaigns. These would encourage recycling and composting, and educate people about why they are important. They could also include information about which materials can be recycled.

Assembly members identified the following pros and cons about product labelling and information campaigns.

Pros

- Better labelling – some assembly members said that "labelling is … visual [and] effective for people to make greener decisions." Others liked the idea of "more clear labelling for recycling" or "labelling (clear) to give information and choice."

- "Helps individuals choose and doesn't restrict choice"

- "Education increases general awareness of all we do, and its consequences"

- "Tackles an existing problem and consumer confusion"

- "Easy and doable"

- "Small change but could be effective"

Cons

- Impact – some assembly members described labelling and information as "light touch – how much difference is it actually going to make? Easy thing to do – probably won't make a huge impact."

Some assembly members noted conditions that they would want to see in order to support this policy option, or that they felt would help its implementation:

- Standardised approach and matching colours – some suggested that we "need [a] national standardised approach to recycling, even international standards e.g. red packaging = red bin – match packing label to bin." Others said it "needs national policy", "needs a national approach rather than local councils having different approaches", or the "same colour bins." Some noted:

"When we sat around the table: everyone had a different recycling coloured bin. With the best will in the world, it has to be made easier: we have [a] blue bin for recycling, green bin for general waste, brown for garden waste. Difficult for people to understand. A traffic light system would help. Costs a fortune though to change the bins. Stickers could be applied rather than changing the bins."

- Increased doorstep recycling – some said it is "dependent on [policy option] 3d [increased doorstep recycling]."

- Virgin materials – some said it's "important to consider [the] use of virgin materials as well as emissions."

Vote results

Assembly members voted by secret ballot on policy options around increasing recycling. There were two ballot papers. The first ballot paper asked assembly members how much they agreed or disagreed that each policy option should be part of how the UK gets to net zero. The second ballot paper asked them to rank the options in their order of preference. The votes from this second ballot paper were counted both in terms of first preference votes and via Borda count.

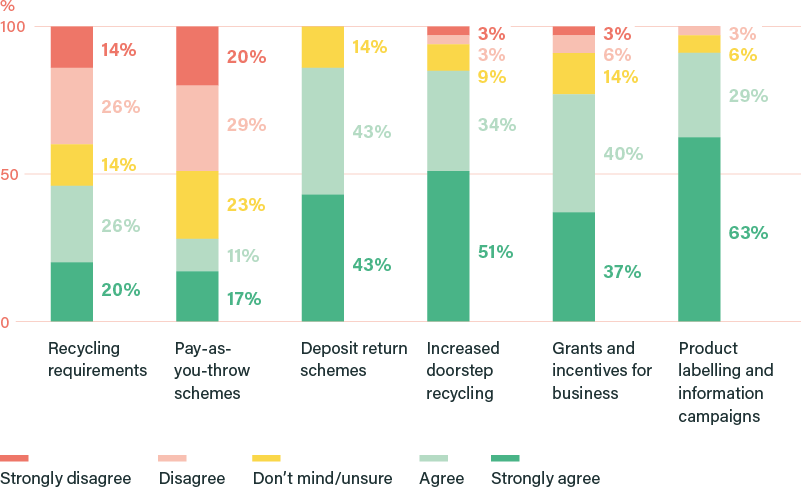

A clear majority of assembly members 'strongly agreed' or 'agreed' that four of the policy ideas should be part of how the UK gets to net zero:

- Product labelling and information campaigns – 92% ;

- Deposit return schemes – 86% (no assembly members disagreed with this idea);

- Increased doorstep recycling – 85% ;

- Grants and incentives for business – 77%.

Only a minority of assembly members supported 'recycling requirements (46%, compared to 40% who 'strongly disagreed' or 'disagreed') or 'pay-as-you-throw schemes' (28%, compared to 49% who 'strongly disagreed' or 'disagreed').

Increasing recycling: How much do you agree or disagree that each of the following policy options should be part of how the UK gets to net zero? (%)

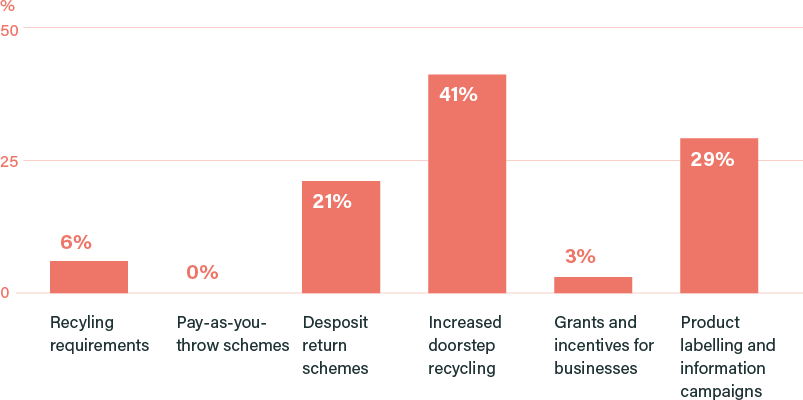

Figure 11: Increasing recycling: Please rank the following policy options in order of preference (% 1st preference votes)

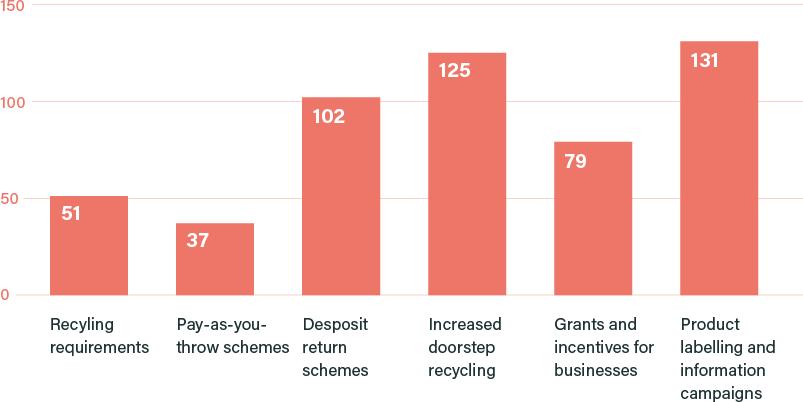

Recycling requirements 51

Pay-as-you-throw schemes 37

Deposit return schemes 102

Increased doorstep recycling 125

Grants and incentives for businesses 79

Product labelling and information campaigns 131

Figure 12: Increasing recycling: Please rank the following policy options in order of preference (Borda count)

The ranking votes largely reinforced these results. 'Increased doorstep recycling' and 'product labelling and information campaigns' emerged as the most popular options, followed by 'deposit return schemes.' 'Grants and incentives for business' scored reasonably well in the Borda count, although less well in terms of first preference votes. 'Recycling requirements' and 'pay-as-you-throw' schemes again brought up the rear.

At the end of weekend three, assembly members had the opportunity to add any further thoughts on 'what we buy' and the path to net zero:

- Imports and displacing emissions – some assembly members said that "we should include imports in net zero" or that "how we deal with imports absolutely should be considered and included by Parliament and government." Others said that "we shouldn't 'displace' our emissions to others and/or absolve ourselves of what is – at least in part – our problem."

- Global leadership – some assembly members stated that "we should be environmentally / climate responsible in terms of our global trading and deals with other countries – we should lead by example."

- Just Transition – some assembly members noted a need to "learn the lesson form the closing of the mining industry i.e. don't abandon communities", or said we should "be proactive to put things in place ahead of the transition to help and support people and communities and encourage new industries." Others stated that we need "to support people who will lose their jobs in the oil and gas sector (e.g. retrained)." Some suggested "ring-fenc[ing] the taxes on oil and gas as a way to contribute to a transition fund."

- Renewable energy and fossil fuels subsidies – some assembly members said that "government shouldn't be deterred by the lobbying of fossil fuel advocates, but should lead the strategy towards more renewable energy alternatives and the employment opportunities therein." Others said they "need to understand why there's a fossil fuel subsidy", talked about "tax breaks given to oil and gas companies" or asked "how much are the current fossil fuel subsidies?"

- Plastics – some assembly members said they were "concerned about making sure [the] plastic question is raised to Parliament."

- Recycling of old appliances – some assembly members said people "need more incentives to recycle their old appliances. Some things you can't repair: that's where businesses have to think about the future. Could be made easier to do: incentivise businesses to do that."

- Waste – one assembly member suggested that we should "stop needless waste by building contractors, retailers etc to prevent over-ordering, over-stocking etc."

- Education and information – some assembly members emphasised the need for education and information suggesting that "if people don't understand what they are buying, they will be led by advertising."

- Long-term, cross-party commitment backed by a permanent citizens' assembly – some assembly members emphasised the need for cross-party commitment a permanent citizens' assembly, including making suggestions about the assembly's membership:

- "Long-term commitment from government. Policy should be set out as cross-party. Worry that [a] new government coming in will change things."

- "Feel very strongly about government and Parliament's commitment, whoever the party is: a permanent citizens' assembly to oversee and hold them to account on the work done is essential."

- "Permanent citizens' assembly: good thing because the assembly will be picked amongst citizens to monitor the implementation of the policies."

- "Need a continuation of the citizens' assembly to monitor the plans taken by whoever takes charge of climate change: communication and co-ordination are key."

- "We need new people. A good mix of people. It can't be the same people as the current assembly."

- "Might be good to get a fresh pair of eyes. Fresh opinions. People's availability will be key."

- "Would it get too political? People would have a political agenda: there should be more young people on [the assembly]. People in their early 20s and teenagers: the next 30 years are not going to affect my generation, but it will affect younger people. Young people should have more of a say. The younger the person is, the least likely they are to have political affiliations: new way of looking at things. Young people have got really good ideas: look at things completely differently. Who would choose is on the citizens' assembly? Could easily become political."

Throughout their discussions, assembly members expressed consistent views on how 'what we buy' should change to help the UK reach net zero by 2050. Their recommendations entail changes for businesses in particular, but also for individuals.

They envisaged a future with five key elements:

- Assembly members strongly supported a future in which businesses make products using less – and lower carbon – energy and materials. They backed a range of specific policies to support this aim, including 'resource efficiency targets and standards' (91%), an 'amended procedure for awarding government contracts that gives preference to low carbon companies and products' (83%), 'taxes on producers, products and services' (83%), and 'extended producer responsibility' (79%).

- Assembly members supported the idea of individuals repairing and sharing more, with less purchasing of new products. They backed 'measures to enable product sharing' (77%) including technical and financial support to businesses who offer sharing or renting services.

- Assembly members' felt strongly about the need for better information to promote informed choice and changes in individual behaviour. They supported 'labelling and information about the carbon emissions caused by different products and services' (92%) and 'product labelling and information campaigns about what can be recycled and why it's important' (92%). They also backed 'advertising bans and restrictions' on high emissions products or sectors (74%).

- Assembly members supported a range of measures aimed at increasing recycling by individuals and businesses, including ' deposit return schemes' (86%), 'increased doorstep recycling' (85%), and 'grants and incentives for businesses' to improve recycling, develop new materials and make goods from recycled materials (77%). Their preferred future included businesses doing more to turn old products into new ones.

- Assembly members called for long-term commitment from government and Parliament. They emphasised the importance of cross-party support to prevent policies changing when governments change, as well as the need to look at both quick wins and long-term solutions.

Some assembly members raised additional points for government and Parliament to consider around a need to take account of imports, ring-fence any tax revenue generated by the above policies, and protect consumers from increased costs. Some also highlighted trust and compliance issues relating to business, asking for transparency, honesty, strong enforcement, and reliable / independent information and schemes. Assembly members welcomed measures that would create additional job opportunities, and stressed the need for a Just Transition for people and sectors adversely affected by the path to net zero.

Assembly members were equally clear about what they did not support. Assembly members did not back voluntary agreements, changes to income tax or working hours, personal carbon allowances, recycling requirements or pay-as-you-throw schemes. Their concerns included that measures would be ineffective or impractical, that they would penalise the less well-off, or that they would have unwanted side-effects such as an increase in fly-tipping.

Next section: Where our electricity comes from

(Contents)

Footnotes

1 Allwood, J., Azevedo, J., Clare, A., Cleaver, C., et al. (2019). Absolute Zero. https://doi.org/10.17863/CAM.46075

2 We explained this fact to assembly members and provided them with brief information about UK and overseas emissions.

3 Age, gender, ethnicity, educational qualification, where in the UK they live and whether they live in an urban or rural area.

4 The assembly heard from six speakers on what we buy: Professor Lorraine Whitmarsh, University of Bath (informant); Professor Mike Berners-Lee, Lancaster University; Professor John Barratt, University of Leeds (informant); Dr Nicole Koenig-Lewis, Cardiff Business School (informant); Julie Hill, WRAP (informant); Libby Peake, Green Alliance (informant). All speakers' presentations are available as slides, videos and transcripts at climateassembly.uk/resources/. An 'informant' is a speaker who we asked to cover the range of views and available evidence on a topic.

5 The assembly went on to discuss carbon capture and storage in detail. Their thoughts and recommendations on it are presented in chapter nine.